Risk management is the cornerstone of successful trading, a principle that separates fleeting gamblers from seasoned strategists. In the fast-paced, high-stakes world of trading, where fortunes can shift in an instant, risk management stands as the ultimate protector of your financial future. For those unfamiliar with trading, the allure of quick profits might overshadow this critical concept, but the truth is undeniable: without risk management, trading is little more than a roll of the dice. This article explores three compelling reasons why risk management reigns supreme in trading, tapping into your values and emotions to show why it’s not just a strategy—it’s your lifeline.

—

## 1. Protecting Your Hard-Earned Money

Picture this: you’ve spent years working diligently, saving every dollar with dreams of growing your wealth. You decide to dip your toes into trading, only to watch those savings vanish overnight due to one reckless move. That sinking feeling—the loss of your time, effort, and aspirations—is a nightmare no one wants to live. Your money isn’t just currency; it’s the embodiment of your hard work and hopes. Risk management is the shield that keeps this nightmare at bay.

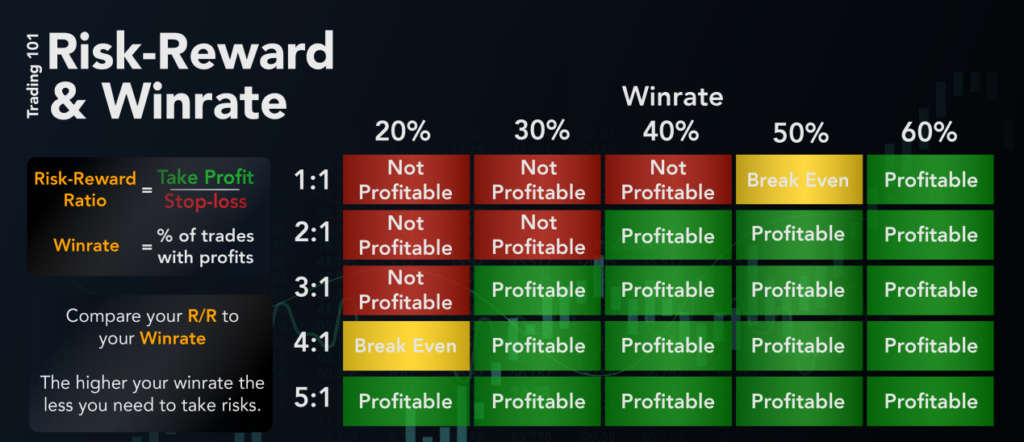

In trading, losses are part of the game. Even the most skilled traders can’t predict every market twist. But risk management ensures that no single loss becomes a catastrophe. Tools like **stop-loss orders**—which automatically exit a trade when it hits a set loss threshold—act as a safety net. Think of it like locking your front door at night: you hope no intruder comes, but the lock ensures your home stays secure. In the same way, risk management locks in your capital, protecting it from the market’s unpredictable storms.

Without this safeguard, one bad trade could erase everything you’ve built. With it, you maintain control, keeping losses small and manageable so your dreams—and your dollars—stay alive for future opportunities.

—

## 2. Peace of Mind in a Chaotic World

Trading can feel like an emotional rollercoaster. One minute, your portfolio is soaring; the next, it’s plummeting, and your heart races with every tick of the market. For those new to trading, this chaos can be overwhelming—sleepless nights, constant worry, and the nagging fear of losing it all. Without a plan, every decision becomes a gamble fueled by panic or greed, eroding your confidence and clarity.

Risk management flips this script. By setting clear boundaries—like deciding in advance how much you’re willing to lose on a trade—you transform uncertainty into structure. It’s like having insurance: you hope you never need to use it, but knowing it’s there lets you breathe easier. With a risk management plan, the market’s wild swings lose their power to rattle you. Instead of dreading the next dip, you trade with calm assurance, knowing your downside is capped.

This peace of mind isn’t just a luxury—it’s a necessity. It frees you from the emotional shackles of fear, letting you focus on strategy over impulse. In a world where you can’t control the market, risk management gives you control over yourself, turning chaos into confidence.

—

## 3. The Path to Long-Term Success

There’s a myth in trading that big risks equal big rewards—that you have to bet it all to win it all. Sure, a lucky high-stakes trade might pay off once, but it’s not a recipe for lasting success. The traders who thrive year after year aren’t the daredevils who got lucky; they’re the disciplined ones who mastered risk management, ensuring they stay in the game no matter what.

Think of the classic tale of the tortoise and the hare. The hare races ahead with bold, risky moves but crashes when luck runs out. The tortoise, steady and cautious, keeps going and ultimately wins. Risk management is your inner tortoise. It’s about playing smart, not fast—keeping your losses small so you can ride out the inevitable storms and still be standing when opportunities arise.

Take Warren Buffett, one of the world’s most successful investors. His golden rule? “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” His billions aren’t built on wild gambles but on avoiding devastating losses through careful risk control. Risk management doesn’t eliminate risk—it’s impossible to trade without some—but it tames it, turning trading into a sustainable pursuit rather than a fleeting thrill.

—

The #StuckInProfit Mentorship Programme will help you master risk and psychology. Get up to 40% Off to begin today! Check it out here https://parutocapital.com/#getstarted

## Addressing the Doubters

Some might argue that risk management stifles profits, closing trades too early and capping your upside. It’s true that a stop-loss might cut a trade short before it soars, but consider the alternative: without it, a plummeting trade could wipe out your entire account. Trading isn’t about hitting a home run every time; it’s about consistent gains over the long haul. Risk management trades the slim chance of a jackpot for the certainty of survival—a tradeoff worth making.

Others might say it’s too complicated for beginners. Not so. Start simple: risk only a small percentage—like 1% or 2%—of your capital per trade. That’s a rule anyone can follow, no expertise required. As you grow, you can refine your approach, but the essence remains: protect what you have. Risk management isn’t a barrier; it’s a beginner’s best friend.

—

## Conclusion: Crown Your Trading with Risk Management

In trading, risk management isn’t optional—it’s the foundation of success. It safeguards your hard-earned money, grants you peace of mind amid market madness, and paves the way for enduring prosperity. For those new to trading, it might feel like a constraint on the excitement of the chase, but it’s the opposite: it’s the key that unlocks a future where you’re not just playing the market but mastering it.

The market will always be unpredictable, but your approach doesn’t have to be. Embrace risk management as your guiding principle, your king on the trading chessboard. Learn its strategies, apply its lessons, and watch it transform you from a hopeful novice into a confident, enduring trader. Your financial future deserves nothing less.